Self Employment Tax Dates 2025. Report someone to iras if you think they are evading tax. How to report profit on your self assessment tax return from 2025 to 2025 if your accounting year does not end on or between 31 march to 5 april.

Deadline for telling hmrc you need to complete a return you must tell hmrc by 5 october if you need to.

Important 2025 IRS dates for selfemployed individuals, First quarter estimated tax payment is due. Quarterly estimated tax payments for the 2025 tax year are due april 15, june 17, and sept.

Self Employment Tax Guide for Online Sellers — Tax Hack Accounting Group, But if the date falls on a saturday, sunday or legal holiday, the deadline shifts to the following business. This includes individuals who have their own businesses, as well as.

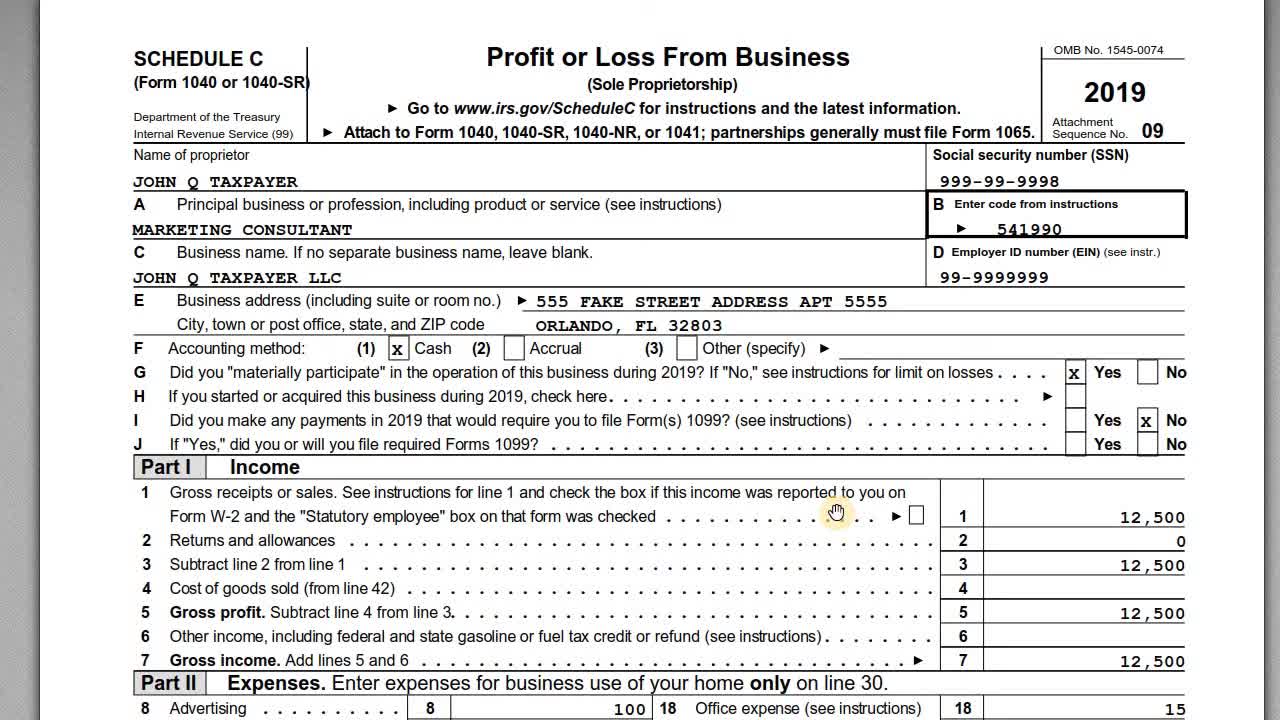

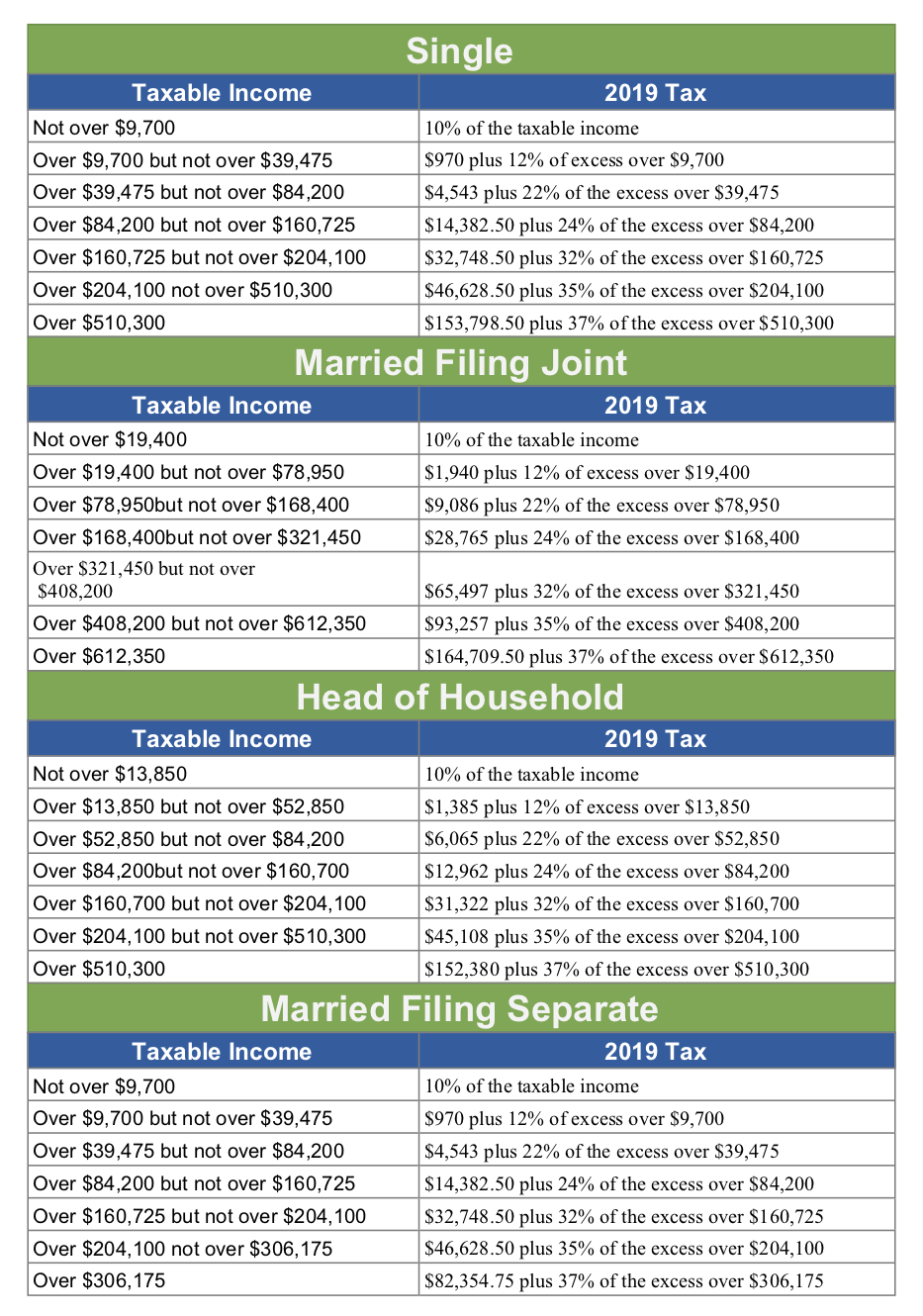

IRS Schedule C with Form 1040 Self Employment Taxes, You’ll pay class 4 national insurance of £2,194.40 which is. Employee’s portion of social security tax for 2025 was 6.2%.

FREE 6+ Sample Self Employment Tax Forms in PDF, How to report profit on your self assessment tax return from 2025 to 2025 if your accounting year does not end on or between 31 march to 5 april. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types.

Fastest SelfEmployment Tax Calculator for 2025 & 2025 Internal, First quarter estimated tax payment is due. You’ll pay class 4 national insurance of £2,194.40 which is.

Understanding selfemployment taxes as a freelancer Tax Queen, Deadline for telling hmrc you need to complete a return you must tell hmrc by 5 october if you need to. If you earned income during this period

How to File SelfEmployment Taxes, Step by Step Your Guide, Tax period 2025 estimated tax due date; Second quarter estimated tax payment is.

Understanding the SelfEmployment Tax, Tax return dates in 2025. The final payment is due january 2025.

The Evolution Of SelfEmployment Taxes And The Reasonable Salary by, Last day to make 2025 retirement contributions june 17, 2025: Federal tax returns typically are due each year on april 15.

SelfEmployment Taxes Explained and Simplified The Accountants for, Multiply your net earnings by 92.35% (0.9235) to get your tax. First quarter estimated tax payment is due.

Notice of assessment) or need to submit your income declaration for purpose such as to apply for government.